If you have seen news or messages about a $4,983 direct deposit in 2026, this guide explains how to confirm eligibility, common payment date patterns, and practical steps to receive the money safely. Use this as a checklist to verify claims and avoid scams.

What the 4983 Direct Deposit 2026 Notice Means

Notices about a 4983 direct deposit could come from federal, state, or private sources. The exact eligibility and timing depend on the issuing agency, so you must verify the origin of any announcement before taking action.

Always cross-check with official websites like IRS.gov, Treasury.gov, or your state agency to confirm a legitimate program. If a private organization offers money, read terms carefully and look for official contact points.

4983 Direct Deposit 2026 Eligibility

Eligibility typically depends on a few common factors: residency, identification, tax or benefit status, and enrollment for direct deposit. Below are practical eligibility checks to perform.

Residency and Citizenship

Most federal or state payments require U.S. citizenship or lawful residency and an address in the issuing state. Nonresidents or people without legal status should verify rules with the issuing agency.

Tax Filing and Benefit Status

Payments tied to tax credits or benefit adjustments often require recent tax returns or current participation in benefit programs. Confirm whether prior-year tax filing or current program enrollment is required.

Banking and Direct Deposit Enrollment

To receive funds as a direct deposit you must provide a valid bank routing and account number to the issuing organization. Some agencies use existing payment records like Social Security direct deposit info.

4983 Direct Deposit 2026 Payment Dates

Payment dates vary by issuer. Agencies typically publish exact schedules, but common patterns include lump-sum payments, phased releases, or monthly installments. Below are typical timelines to expect.

- Lump-sum: One one-time deposit (often posted within a single business day once processed).

- Phased release: Payments sent in waves based on identifiers like last digit of Social Security number or receipt date.

- Monthly installments: Payments divided into monthly disbursements over a fixed period.

Estimated example schedules (for planning only):

- Wave A: SSN ending 0–3 — March 2026

- Wave B: SSN ending 4–6 — April 2026

- Wave C: SSN ending 7–9 — May 2026

These are illustrative only. Check the issuing agency’s official calendar for exact dates and any updates.

How to Confirm Your Eligibility and Payment Date

Follow these steps to verify whether you should expect a 4983 direct deposit and when it will arrive.

- Check official announcements on government sites (IRS, Treasury, state websites) and trusted news outlets.

- Log in to relevant agency accounts (IRS, SSA, state portals) to see payment notices in your secure inbox.

- Confirm your bank account details in the agency portal or call official support numbers listed on the agency site.

- Watch for official emails from domains ending in .gov or your state’s domain; be skeptical of unsolicited texts or calls.

What to Do If You Don’t Receive the Deposit

If you expect a payment but don’t see it by the announced date, take these practical steps. Acting quickly helps resolve issues like incorrect banking details.

- Recheck your account number and routing number with the agency portal.

- Contact the issuing agency using the phone numbers listed on their official website.

- Ask your bank to trace incoming ACH transfers if the agency confirms a payment was sent.

- Keep records: screenshots of portal notices, confirmation emails, and bank statements.

Most government direct deposits use the Treasury Electronic Payment system and appear in bank accounts overnight once processed. Always check the issuing agency first before contacting your bank.

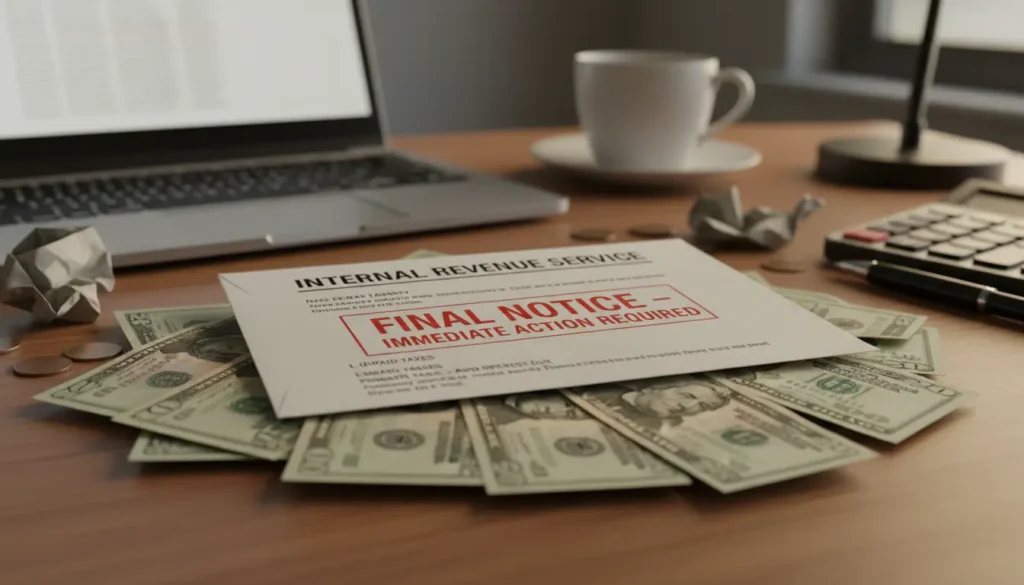

Red Flags and How to Avoid Scams

Scammers commonly mimic official programs to steal personal or banking information. Recognize red flags and protect yourself.

- Red flag: Unsolicited calls or texts asking for full bank account numbers or Social Security numbers. Legitimate agencies will not request sensitive details by text or phone first.

- Red flag: Links to non-official websites or email addresses not ending in .gov or official state domains.

- Protective action: Only enter banking details on verified portals and use multi-factor authentication when available.

Real-World Example: How One Recipient Confirmed a 4983 Deposit

Case study: Maria, a teacher in Ohio, received an email saying she would get a 4983 direct deposit. She had questions about legitimacy.

First, Maria visited the Ohio state website and found a public notice describing the program and a published payment schedule. She logged into her state benefits portal, verified her bank account details, and saw a pending payment scheduled for April 15, 2026. On April 16 she checked her account and confirmed the direct deposit posted as expected.

Checklist Before You Expect a 4983 Direct Deposit 2026

Use this quick checklist to prepare and avoid delays or fraud.

- Confirm program details on an official website.

- Verify bank routing and account numbers in the agency portal.

- Keep tax and benefit records up to date.

- Monitor official email or portal messages for scheduling updates.

- Report suspicious contacts to the agency or the FTC.

Final reminder: any payment program that sounds official should be confirmed through the issuing agency’s published channels. If you follow the steps above, you’ll be ready to receive a 4983 direct deposit in 2026 — or to spot and avoid a scam.