This guide explains the January 2026 Federal 2000 direct deposits rules and timeline in practical terms. It covers who is eligible, how banks process deposits, important cutoff dates, and steps to prepare so you receive funds on time.

January 2026 Federal 2000 Direct Deposits Rules Overview

The Federal 2000 direct deposit refers to a scheduled federal payment of $2,000 made by electronic transfer to eligible recipients in January 2026. Federal agencies and the U.S. Treasury set the high-level rules, but banks and payroll processors follow implementation guidelines that affect the actual receipt date.

Key elements of the rules include eligibility verification, enrollment deadlines, and bank posting practices. Understanding each helps avoid delays.

Who is eligible for the Federal 2000 direct deposits

Eligibility depends on the program behind the payment (for example, a one-time stimulus, retroactive benefit, or other federal disbursement). Common checks include:

- Citizenship or residency status as required by the program

- Income or asset thresholds where applicable

- Valid Social Security number or taxpayer identification

- Active enrollment in direct deposit via your bank routing and account numbers

Confirm eligibility notices from the issuing federal agency and watch official communications for any last-minute changes.

How banks and the Treasury process January 2026 direct deposits

The U.S. Treasury issues payment files to the Automated Clearing House (ACH) network. Participating banks receive ACH credits and then post them to customer accounts based on internal rules.

Typical steps are:

- Treasury generates payment file and sends to ACH on scheduled business day

- ACH clears transactions and forwards them to recipient banks

- Banks post credits to accounts, often in the morning or after internal review

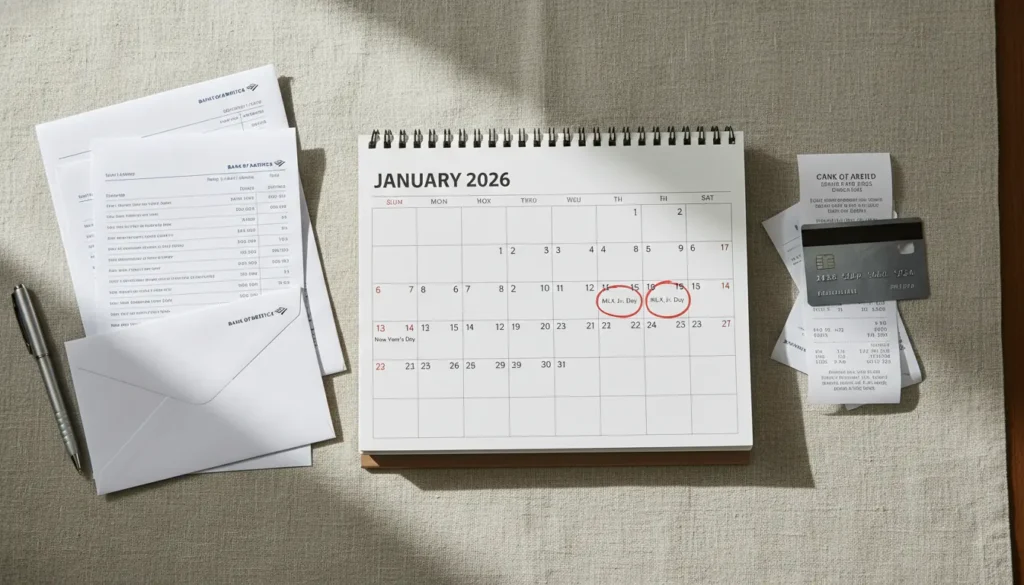

Timeline for January 2026 Federal 2000 Direct Deposits

Timelines can vary by issuing agency and bank, but here is a practical baseline you can expect. All dates assume normal business days and no bank holidays affecting processing.

- 2–3 weeks before scheduled payment: Agencies finalize recipient lists and send notices.

- 7–3 days before payment: Treasury submits file to ACH for clearing.

- Payment date (official): ACH posts credit to recipient banks; banks begin posting to accounts.

- 1–2 business days after payment: Some banks clear holds or review large credits before final posting.

If the official payment date falls on a weekend or federal holiday, payments typically move to the prior business day. Check agency announcements for exact dates.

Bank posting rules that affect when you see the money

Banks may apply different posting rules. Common practices that affect timing include funds availability policies, fraud screening for large credits, and differing cut-off times for ACH credits.

Tips to keep in mind:

- Smaller banks may post credits faster or later depending on internal schedules.

- Larger credits can trigger additional verification leading to temporary holds.

- If you change banks or accounts close to the payment, re-enroll early to avoid rejection.

How to prepare for your January 2026 Federal 2000 direct deposit

Take these steps at least two weeks before the expected payment date to reduce delays.

- Confirm eligibility and enrollment with the issuing agency online or by phone.

- Verify your bank routing and account numbers; update them if they changed.

- Contact your bank to ask about ACH credit posting times and any potential holds for large deposits.

- Monitor your account starting the morning of the official payment date and for 48 hours afterward.

If you do not receive the deposit within the expected window, contact both the issuing agency and your bank. Keep any correspondence and confirmation numbers handy.

Common problems and quick fixes

If a payment is delayed or rejected, the cause is usually one of a few common issues. Knowing the cause helps you resolve it faster.

- Incorrect bank account numbers — update enrollment and ask the agency to reissue if possible.

- Account closed — provide a new account and request reissuance.

- Bank hold for verification — ask the bank why the hold was placed and provide requested documentation.

Federal ACH files often reach banks overnight, so many payments post between 6 a.m. and 10 a.m. local time on the official payment date.

Real-world example: Case study

Case: Maria, a retired teacher, expected the $2,000 federal payment in January 2026. She had recently switched banks and updated her direct deposit with the agency 10 days before the payment date.

Outcome: The agency’s system processed the change but flagged the new account for verification. The ACH file sent the payment to the old account number, which was closed. Maria received a rejection notice from the issuing agency within two business days and the agency reissued the payment to her verified account, which posted three business days after the original date.

Lesson: Re-enroll at least two weeks before the payment and confirm the agency shows your account as verified to avoid reissuance delays.

When to contact officials and what to say

Contact the issuing agency if the official payment window has passed (usually 5 business days) and you have not received funds. Contact your bank immediately if a credit appears pending or is returned.

When you call, have these details ready:

- Full name and taxpayer ID or social security number (as appropriate)

- Official notice or reference number from the agency

- Bank routing and account numbers you provided

- Dates you updated your enrollment, if applicable

Keeping clear records speeds resolution.

Final checklist before January 2026 payments

- Confirm eligibility and enrollment with the issuing federal agency.

- Verify bank account and routing numbers at least two weeks early.

- Ask your bank about ACH posting times and potential holds for large credits.

- Monitor your account the morning of the expected payment and for two business days afterward.

- Contact the agency and bank promptly if payment is missing or returned.

Following these steps will reduce the chance of a delayed January 2026 Federal 2000 direct deposit and help you resolve issues quickly if they arise.